Forex fundamental Examination is actually a cornerstone of effective buying and selling, providing useful insights to the forces driving forex values. It consists of analyzing financial indicators, political events, and sector sentiment to predict upcoming cost actions. This manual aims to supply a thorough knowledge of forex essential analysis, serving to traders make informed conclusions and increase their investing procedures.

What's Forex Fundamental Evaluation?

Forex elementary analysis consists of inspecting macroeconomic indicators, including GDP, desire premiums, and inflation, to determine the intrinsic value of a currency. Not like technical analysis, which concentrates on rate designs, basic analysis assesses the broader economic setting to predict forex movements.

Vital Economic Indicators in Forex Essential Assessment

Being familiar with crucial economic indicators is important for powerful forex elementary analysis. These indicators present insights into a rustic's financial overall health and affect currency values.

one. Gross Domestic Product or service (GDP): GDP actions a rustic's financial output and growth. A increasing GDP signifies a balanced financial state, typically leading to a more powerful forex.

2. Curiosity Premiums: Central banking institutions manipulate interest rates to control inflation and stabilize the overall economy. Greater curiosity charges normally appeal to international expenditure, boosting the forex value.

3. Inflation Rates: Inflation steps the speed at which costs for goods and solutions rise. Reasonable inflation is typical, but abnormal inflation can erode a forex's purchasing electricity.

Central Banks and Monetary Coverage

Central banking companies Participate in a pivotal purpose in forex fundamental Assessment. They established fascination costs and implement monetary procedures to control financial steadiness.

1. Interest Charge Decisions: Central banking companies modify fascination fees to manage inflation and promote or great down the economic system. Traders check out these selections closely since they could cause significant currency fluctuations.

2. Quantitative Easing: This coverage entails paying for federal government securities to enhance the dollars supply. It aims to decrease fascination rates and promote economic progress, generally weakening the forex.

Political and Geopolitical Occasions

Political stability and geopolitical activities appreciably impact forex values. Elections, coverage variations, and Intercontinental conflicts could potentially cause market volatility.

one. Elections: Election results can cause policy modifications affecting financial progress and stability. Market sentiment normally shifts based upon the perceived economic influence of the new administration.

two. Geopolitical Tensions: Conflicts and tensions in between nations around the world can disrupt trade and economic steadiness, leading to forex depreciation.

Trade Balances and Existing Accounts

Trade balances and present-day accounts reflect a country's economic transactions with the remainder of the entire world. They offer insights into the desire for a rustic's forex.

one. Trade Balance: The trade harmony steps the distinction between a rustic's exports and imports. A constructive trade equilibrium (surplus) indicates a lot more exports than imports, strengthening the currency.

2. Latest Account: This accounts for all Intercontinental transactions, including trade, expenditure money, and transfers. A surplus suggests a Internet inflow of international currency, boosting the forex's benefit.

Market Sentiment and Speculation

Market sentiment, driven by buyers' perceptions and speculations, can cause short-time period forex fluctuations. Comprehension industry psychology is essential for forex elementary Investigation.

1. Trader Self esteem: Constructive economic information can Enhance Trader assurance, resulting in amplified desire for the forex. Conversely, unfavorable information can result in forex sell-offs.

2. Speculative Buying and selling: Traders normally speculate on foreseeable future financial occasions, driving currency price ranges based mostly on their own anticipations. These speculative moves could cause shorter-term volatility and make buying and selling options.

Making use of Forex Essential Evaluation in Trading

To apply forex elementary Assessment effectively, traders will have to stay knowledgeable about economic occasions and details releases. This is a stage-by-stage approach:

1. Remain Up to date: Regularly observe economic information, central lender announcements, and geopolitical developments. Financial calendars are important resources for monitoring key situations.

2. Analyse Information: Evaluate how financial indicators and occasions align with your buying and selling technique. Think about the opportunity effect on forex values and industry sentiment.

three. Produce a technique: Use fundamental Investigation to build a investing method that accounts for financial traits and possible sector shifts. Mix Forex Fundamental Analysis it with complex Assessment to get a holistic strategy.

4. Possibility Administration: Essential Assessment can help discover prospective risks and chances. Carry out chance management approaches to protect your investments and maximise returns.

Prevalent Concerns and Worries

How exact is forex essential Evaluation?

Basic Investigation is not really foolproof but provides useful insights into current market traits. Combining it with technical Evaluation can boost precision.

Can newcomers use elementary Investigation?

Absolutely! Newbies can commence by knowledge essential economic indicators and their impact on forex values. Eventually, they are able to create much more advanced techniques.

How often should I perform essential Investigation?

Standard Evaluation is important for productive buying and selling. Stay current on economic events and periodically evaluate your approach depending on new information and market ailments.

Conclusion

Forex elementary Evaluation is A necessary Resource for traders in search of to know and foresee marketplace actions. By analysing economic indicators, central financial institution insurance policies, political functions, and sector sentiment, traders might make educated decisions and produce strong buying and selling procedures. Remain knowledgeable, continually refine your technique, and combine fundamental Assessment with other methods to accomplish trading good results.

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Richard Thomas Then & Now!

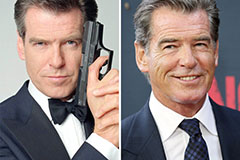

Richard Thomas Then & Now! Pierce Brosnan Then & Now!

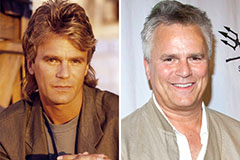

Pierce Brosnan Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!